Types and Interpretation of Credit Scores

You are probably familiar with the term “FICO score” as it is often used interchangeably with “credit score.” Indeed, the FICO (Fair Isaac Corporation) credit scoring model is the most widely-used of its kind in the United States, and your FICO score is the number most lenders reference as your credit score to determine your creditworthiness.

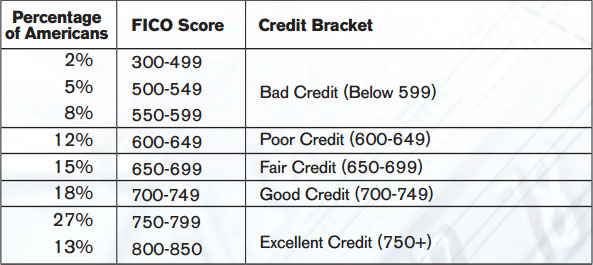

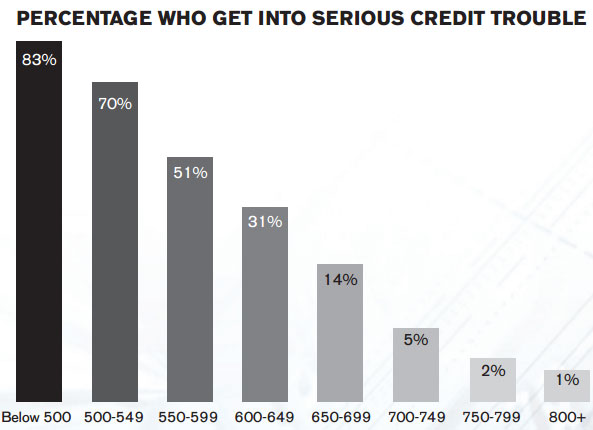

FICO scores range between 300 and 850, with a median score of 723. A score of 599 or lower is typically considered “bad,” whereas a score of 750 or above is considered “excellent.” (See Figure 3). The higher your FICO score, the lower your perceived risk to creditors. For example, a “good” score ranging from 700 to 749 indicates you have a low, five percent risk of developing serious credit problems (See Figure 4).

When it comes to qualifying for a mortgage loan, a FICO score of 620 is typically the cut-off – at least, such is the case since the post-2008 financial collapse. If you do manage to qualify for a mortgage with a sub-620 FICO score, expect to pay very high interest rates.

You actually have three FICO scores, as the three national credit reporting companies (CRCs) that collect the credit report information which determines your credit score – Equifax, Experian and TransUnion – each have their own databases. Depending on the CRC, FICO scores are also marketed under different names, such as Beacon (Equifax) and Empirica (TransUnion). The three CRCs won’t necessarily show identical FICO scores for any individual, since they may all pull from slightly different sets of data. However, credit scores based on the FICO algorithm will rarely deviate significantly for the same individual, unless of course there is incorrect information being reported.

or worse (bankruptcy, account charge-off, etc.) on any credit account over a two-year period.

There are also specialized FICO scoring versions which only lenders see. For example, the auto-enhanced FICO score, which emphasizes auto loan history, is used to determine your auto loan-worthiness and interest rates, while many credit card companies use a bankcard-enhanced FICO score when reviewing a credit card application.

Further complicating the matter, the three major CRCs introduced their own credit scoring system to compete with FICO in 2006. The CRCs’ competing credit scoring model, VantageScore, produces credit score values ranging from 501 to 990. FICO has filed a federal lawsuit against VantageScore, which is ongoing. As a consumer, you don’t really need to worry about your VantageScore as it isn’t widely used by lenders – according to court documents filed for the federal case, VantageScore’s market share is only six percent.

VantageScore and other non-FICO credit scores are also sometimes called “FAKO” or “Fake-O” scores – a derogatory play on FICO. As their nickname implies, you’d be wise not to bother with FAKO scores — and you certainly shouldn’t pay for one. As a consumer, the most meaningful credit score number you need to know is your FICO score provided by one of the authorized CRCs – or even better, the average of your three FICO scores.