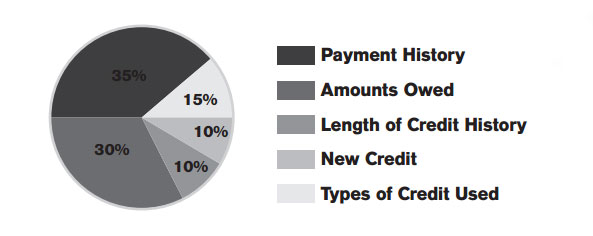

What Determines Your FICO Score?

Your FICO score is calculated using various credit-related data from your credit report. The credit information that determines your FICO score can be grouped in to five categories: payment history, credit utilization, length of credit history, new credit, and types of credit used.

Payment History

- Account payment information (includes credit cards, retail cards, finance company accounts, installment loans, mortgage, etc.)

- Existence of derogatory public records (suits, liens, wage garnishments, bankruptcy, judgments, etc.), delinquencies (past due items), and collection items

- Severity and number of delinquencies

- Amounts and recency of delinquencies, adverse public records, and/or collection items

- Number of accounts paid as agreed

Credit Utilization

- Total amounts owing on accounts

- Amounts owing on specific kinds of accounts, including revolving credit accounts and non-mortgage installment loans (owing large amounts on these types of accounts indicates greater risk to lenders)

- Lack of a specific type of balance, such as no recent non-mortgage balance or no recent revolving balances

- Number of accounts with balances

- Proportion of credit lines used (also referred to as your debt-to-limit ratio or debt utilization rate)

- Proportion of installment loan amounts still owing

Length of Credit History

- Time since accounts were opened

- Time since specific types of accounts were opened

- Recency of account activity

New Credit

- Number of recently opened accounts, and proportion of recently opened accounts to total accounts (Type of recently opened account is also important)

- Number and recency of credit card inquiries

- Time since most recent account openings, by type of account

- Positive credit history since past payment issues

Types of Credit Used

- Number, presence and prevalence of various account types (mortgages, consumer finance accounts, installment loans, retail accounts, credit cards, etc.)

- Any recent information on various types of accounts