What Is A Credit Score and How Does It Affect You?

Before you can improve your credit score, it’s important to first make sure you have a good understanding of exactly what a credit score is and how it impacts your financial situation. In a nutshell, your credit score is a number from your credit report that represents how likely you are to repay a loan on time. The higher your credit score, the more confident a lender can feel about doing business with you, and thus, the more likely you are to get approved for a line of credit.

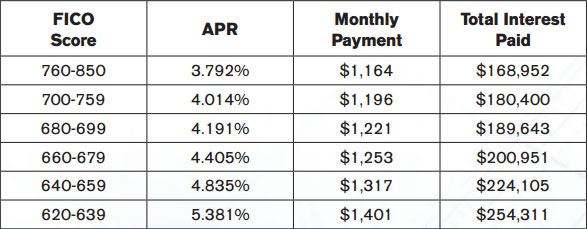

Besides using it to decide whether or not to grant you a loan, banks and other lenders use your credit score to determine what interest rates to charge you. In order to mitigate their risk, a lender will typically charge a higher-than-average interest rate to someone with a below-average credit score. Simply put, this means that borrowing money is more expensive for people with a bad credit history.

For major loans such as a mortgage, your credit score and resultant interest rates can produce a huge impact on both your monthly payments and on the total amount you have to repay the bank over the years. For example, based on current national averages as of October 2011, on a $250,000 30-year fixed mortgage, a person with an “excellent” credit score will pay about $169,000 in total interest by the time the loan is paid off, whereas someone with a “fair” credit score will pay roughly $254,000 in interest (See Figure 1).

Unfortunately, a bad credit score can have a vicious-circle effect, as high monthly payments make it even more difficult for you to pay your bills on time, ultimately causing your credit score to drop even further.

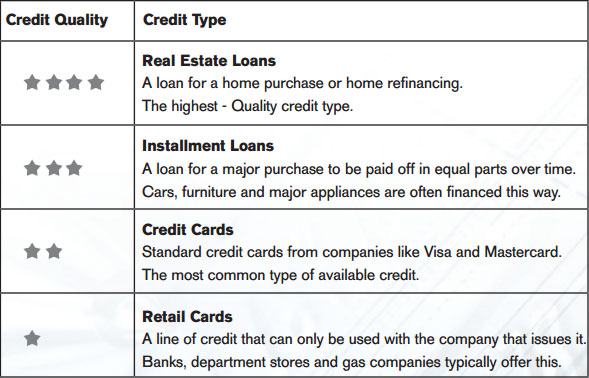

It’s also important to note that your credit score impacts you differently for different types of loans. This means that while your below-average credit score may not be high enough to qualify you for a real estate loan, it may qualify you for lower-quality loans like an installment loan or credit card. Conversely, the type and quality of your existing credits also affects your credit score. But we’ll look more closely at the factors that affect your credit score later on.