How much money would you like to have saved for the holidays? Or your next vacation? Or your emergency fund?

Whatever your goal, the number probably seems overwhelming.

Trying to figure out where several hundred or a few thousand dollars might come from is tough. Instead, break it down. Find ways to set aside just a little bit at a time — you’ll be surprised how quickly you can move toward your goal!

To help you get started with that first step, we’ve put together 12 easy things you can do to help save money this year!

You’re about to be shocked! If you are like most Americans, your money is being drained without you realizing it. There are ways you can stop it, and start saving your money and earning more.

1. Lower Your Mortgage Payment

If you’re a homeowner and you want to save yourself thousands of dollars this year, there’s a government program that you might be able to take advantage of called HARP. The Home Affordable Refinance Plan (HARP) could help hundreds of thousands of Americans reduce their monthly payments by as much as $3,500 in their first year. The program was set to expire in 2017 but has been extended to 2018 for the time being. In order to qualify for HARP you’ll need good or excellent credit, so if you don’t have a very good credit rating then this probably isn’t for you. To check if you qualify visit HARP Approvals, and fill out the short quiz (take 2 minutes). If lowering your payments, paying off your mortgage faster, and having an extra $290 a month in HARP savings during the first year of your mortgage would help you, then this could be the easiest money savings tip you take.

2. Install a Home Security System

Would you like to save up to 20% on your homeowner’s insurance? That’s typically the savings insurance companies give for having a home security system. Why? Because 90% of convicted burglars admit that they avoid homes with alarm systems. And because homes without alarms are three times more likely to be targeted. Improve safety. Sleep better. And save money! More than six million Americans rely on ADT to protect them. Find out from your insurance company about the discount you’ll get with a security system, and then find the system that fits you. Right now, there are huge discounts and incentives.

3. Drive for Lyft

Be your own boss, set your own schedule, get paid instantly, and meet interesting people. That’s the daily (or nightly) life of Lyft drivers. Tips, weekly bonuses, referral bonuses, and driving pay: these are the ways drivers make dough. You get paid for the time and distance of every ride. A survey showed that Lyft drivers earn, on average, about $17.50 an hour. You can work part-time or full-time and keep all the money you get from doing what you enjoy: driving. If you’re looking to supplement your income, save some money for something special, or avoid working in a cubicle, look into driving with Lyft.

4. Pay Less For Car Insurance

Would you like to pay less than $50 per month for your car insurance? Car insurance is mandatory for every driver, but that does not mean you have to pay an excessive premium. If you have no accidents or moving violations in the past two years, you can probably get a much lower rate than you currently pay and join the 5% of Americans who figured out how to pay less than $50 a month! In the past, you’d have to shop around and call several companies to compare rates. Today, you can use a website tool that shows you comparable rates from top companies, letting you make the clear choice. See how low you can get your rate and tell your friends!

5. Save With Solar Panels

Install solar panels and they will give you so much back in return. For starters, you will save 30 percent on the installation because of the federal investment tax credit (ITC), and there’s no cap. (The ITC expires in December 2018.) Your monthly electricity bill will be much lower and might even be $0, but you might have to pay a nominal connection fee each year. Your bill will not be affected by rate hikes or spikes in fossil fuel prices. When you decide to sell your home, the panels will increase its value. Buyers will typically pay $15,000 MORE for a home with an average-sized solar power system. Save on the installation. Save on the monthly bills. Earn on the sale of your home. Check out getting solar panels for your home.

6. Pay Smaller Health Insurance Premiums

If you’ve figured out the Affordable Health Care Act, you’re smarter than most of us. Yet, it is important you have a good policy that will cover you if you ever need it. This does not mean you have to spend extra money. On the website Obamacare Health Plans, you can find information to help you understand your options. The site also provides you with an easy way to compare rates. If you don’t have coverage yet, by law (and threat of fines) you need to obtain coverage quickly. Visit the site and answer some questions to find the best plan at the lowest price for you.

7. Make Money Taking Online Surveys

One very interesting way to pull in some extra money is taking online surveys. These surveys can vary in topics from public opinion to product usage habits. You earn a little for each survey you take and if you use your time wisely, you can add several surveys to your daily or weekly routine. Lunch breaks, bus rides, and nights are opportunities to take surveys and earn spending money or build your stash of savings. Survey Junkie is a site that offers popular gift cards or Paypal cash. Check it out and start bringing in extra cash with your opinions.

8. Cancel Your Cable For Free TV

How much do you pay each month for your cable TV subscription? $25? $55? $95? What if you could get a lot of the same programs—top programs—for free? What would you do with all the subscription money you save? You can still get access to network TV—for free. That includes ABC, CBS, FOX, NBC, PBS, The CW, Univision and more. All free. You just need the right antenna. One antenna that is available to consumers is ClearView. It’s real, and it’s legal. It stays indoors, it’s sleek and discreet, and it delivers all your local news, weather, sitcoms, cooking shows, kids’ shows, sports and thousands of movies. If you’re not spending significant time on specific cable channels, cut the cord, save your money, and enjoy free TV.

9. Purchase Airline Tickets On Sunday

A study by Expedia and Airlines Reporting Corporation (ARC) analyzed billions of ticket sales in 2016. The study found that generally you can save the most money on airline tickets if you purchase them on Sunday more than 21 days ahead of your flight. Also, flights that include a Saturday-night stay offer the best prices. Also, if possible avoid booking flights for holidays like Christmas or New Years as airlines love to hike up the prices whenever they can.

10. Activate Automatic Savings

Open a separate account at your bank and set up an automatic deposit each month from your existing account. Then, each month, the amount you specify will automatically transfer from your account to your savings account. You probably won’t miss the money when it is transferred out, and at then end of the year, your savings account will have accumulated a nice stash of cash.

11. Pay Yourself A Percentage

In the same vein as above, work out with your employer to automatically deposit a portion of your paycheck to a separate savings account. You probably won’t miss the deduction and at the end of the year, you’ll have a nice amount of savings. At the end of five years, it will be a significant sum that would not exist had you kept it in your take-home pay.

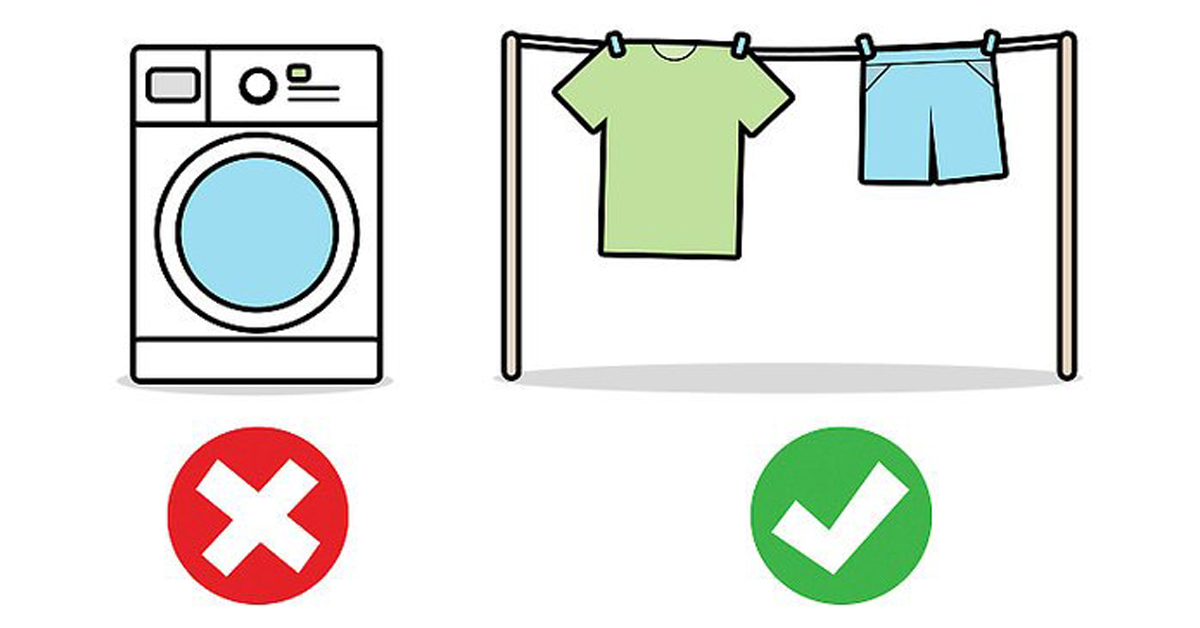

12. Use Less Energy At Home

Cutting back on energy around the house could save you hundreds of dollars each year. Here are some tips: Wash your clothes in cold water and hang them to dry. Keep air conditioning and heating filters clean. As much as you can, opt for open windows or fans versus switching on the air conditioner. Allow sunlight to provide interior illumination instead of using electricity-consuming bulbs. Upgrade to a digital thermostat you can program to regulate your home’s temperature. Any or all of these will keep more of your money in your pocket.

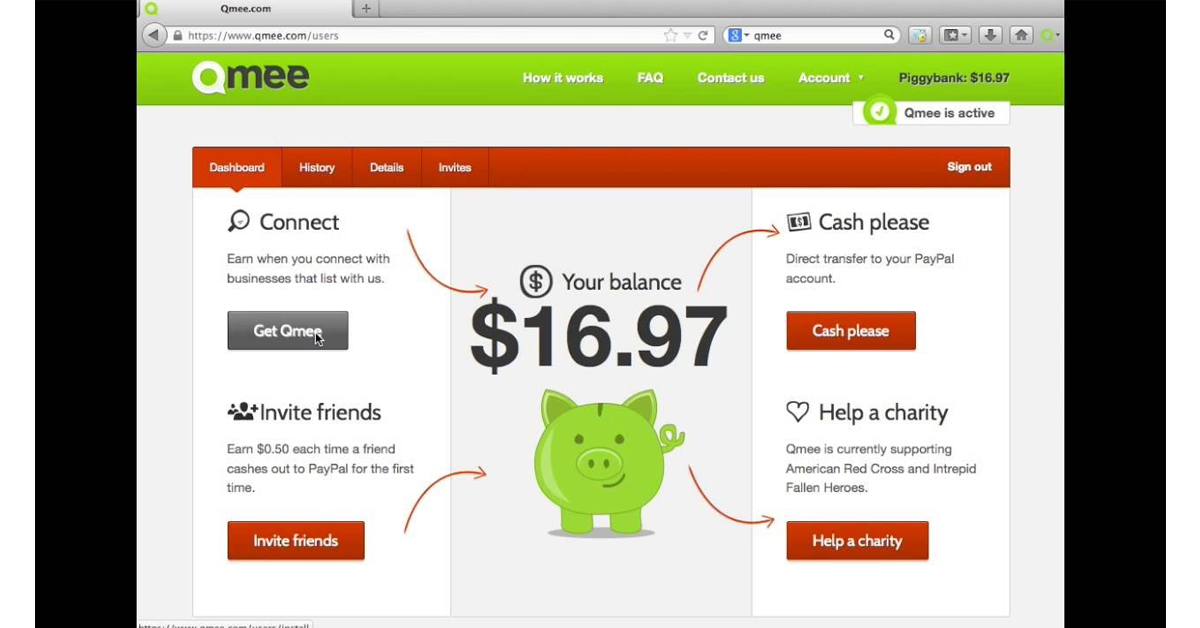

13. Get Paid To Search The Web

If you enjoy being online, this is a no-brainer. You can search for stuff and shop online like you usually do, but with the free Qmee browser app. You’ll get more and even get paid! Qmee lets you shop, earn, and save. You’ll get the best prices plus coupons and deals on the items you’re shopping for. You can even earn cash rewards if you take surveys, paid in gift cards to save you from spending your own money. Check out Qmee and start searching, shopping, and saving.