So you’re one of the lucky 2/3 of Americans who own a home and no longer have to pay rent. That’s great, but by no means is home ownership cheap. With the rising costs of living, finding ways to save money is something that everyone should do.

Here are 13 things to do immediately that will reduce the maintenance costs of your home over the long haul. You can read about them and click any of the links provided for more information.

1. Check The Insulation in Your Attic – And Install More If Needed.

If you have an unfinished attic, pop your head up there and take a look around. You should see insulation up there between the beams, and there should be at least six inches of it everywhere (more if you live in the northern part of the United States).

If there’s inadequate insulation up there – or the insulation you have appears to be damaged – install new insulation. Here’s a great guide from the Department of Energy on attic insulation, including specifics on how much you should have depending on where you live. Many states offer financial incentives, up to a 75% refund for instance, to encourage homeowners to better insulate their homes.

2. Negotiate A Better Mortgage Rate With HARP

If you’re a homeowner and you want to save yourself thousands of dollars this year, there’s a government program that you might be able to take advantage of called HARP. The Home Affordable Refinance Plan (HARP) could help hundreds of thousands of Americans reduce their monthly payments by as much as $3,500 in their first year. The program was set to expire in 2017 but has been extended to 2018 for the time being. In order to qualify for HARP you’ll need good or excellent credit, so if you don’t have a very good credit rating then this probably isn’t for you. To check if you qualify visit HARP Approvals, and fill out the short quiz (take 2 minutes). If lowering your payments, paying off your mortgage faster, and having an extra $290 a month in HARP savings would help you, then this could be the easiest money savings tip you take.

3. Never Pay For Home Repairs Again

Many homeowners don’t have the extra cash to shell out for repairs when something in the house breaks. You most likely have homeowners insurance right? But what about if your washing machine of 10 years breaks down? Or your dryer just stops working one day? Homeowner insurance won’t cover those repairs. That’s why getting setup with a Home Warranty Program can actually end up saving you a lot of money in the long run. It will cover any unexpected repairs to your appliances, plumbing, water heaters, heating and other electrical systems. They also will replace anything that they can’t fix. Make sure you shop around for rates on a home warranty program – this website will give you quotes that you can then choose from. A home warranty program should be a minor cost that can end up saving you major money.

4. Lower The Temperature on Your Water Heater Down To 120 Degrees Fahrenheit (55 Degrees Celsius)

This is the optimum temperature for your water heater. Most people don’t use water hotter than 120 degrees — indeed, water hotter than that can scald you or a child — and thus the energy needed to keep the water above 120 degrees isn’t used effectively. Lower the temperature, save money on your energy bill, and you’ll never skip a beat.

5. Install A Home Alarm System

Did you know that homes without security systems are 2.5 times more likely to be targeted by burglars and intruders? But installing a home alarm system isn’t just to stop burglars and intruders, it can also save you big money year after year. A house alarm will save you money on your homeowners insurance policy (which is generally mandatory if you own a home). In fact, on average installing a home alarm system will give homeowners a 10-20% discount on their insurance by having a high functioning home alarm system installed. The good news is that these home alarm companies are pretty desperate for customers at the moment so you can get a good deal. For instance, one of the best alarm system companies – ADT is currently offering over $800 in savings if you just pay the installation fee. That means you basically get a free alarm system for over a year, just by paying a $99 fee.

6. Reduce Your Electricity Bill With Solar Panels

For Homeowners, rising monthly electricity costs can make you feel like you’re always living paycheck to paycheck. The good news is that now more than ever the government is offering subsidies to install solar panels. That means if you live in a sunny part of the United States, you may be able to qualify for a free installation, and it will significantly reduce your electricity costs in a matter of weeks. In fact, some Americans have saved as much as $183 per month on their energy bills. If you’re not happy with solar panels, you can always wait until the new Tesla home Powerwall is ready and purchase that. If you’d like to get a quote on solar panels in your area – you can visit Home Solar Installation and get an idea of how much money you can save by making the switch.

7. Deduct Your Mortgage Interest On Your Tax Return

A report from Congress’ Joint Committee on Taxation estimates some $70 billion in mortgage interest deductions annually among American taxpayers. Make sure you get your fair share — not just because mortgage interest can be substantial, but this tax break alone opens the door for many taxpayers to itemize other, smaller breaks instead of settling for the standard deduction. Simply use Form 1098 if you have paid more than $600 in mortgage interest in the tax year.

8. Save Money on New Windows

Many people opt to replace old drafty windows at home with new energy-efficient ones. Replacing old windows can also lower your utility bill by 40% per month and increase your home’s curb appeal. You may also qualify to save $100s in seasonal discounts from manufacturers like Pella, Champion, and Andersen. Make sure you find the best price you can get by visiting Modernize Windows to compare pricing from local professionals.

9. Save Money on a New Roof

Similar to replacing your windows, replacing your roof can be an expensive investment faced by all homeowners eventually, but the savings made with long term damage from leaky roofs and badly insulated houses make it an important part of protecting your home from long term damage. Be sure to get quality work done as it is important to make sure your new roof lasts a long time,

10. Consolidate All Your Existing Debt Into One Simple Payment

Debt consolidation is the process of combining all your unsecured debts into a single monthly payment. Generally this allows for much lower payments on a monthly basis than the sum total of the separate debts – making life a lot more manageable. The likelihood in these circumstances of reducing interest rates is very high, and there are many firms out there who will walk you through the process making it simple and painless. If you have more than $10,000 in debt, then this is something you should do right away. You can get the best quote to consolidate all your unsecured debt by clicking the link below.

11. Automate Your Thermostat or Use A Post-It Note

In my first home, I would manually turn up the thermostat as I walked out the door to work, and I would manually adjust it down when I came home in the evening. Last year I replaced all of the thermostats in my house with the Nest learning thermostat. It learns your schedule to keep your home comfortable when you are home. Nests’ are pricey, but according to the Nest website, some energy companies will give you a $249 Nest Thermostat free when you sign up for some of their plans. Definitely check with your utility provider to see what you can get from them. If you can’t get a free or discounted smart thermostat from your utility provider, you can go the manual route like I used to. Go get a sticky note, and put it on the door you take to leave your home. Write a reminder to change the thermostat as you walk out the door. Simple and free.

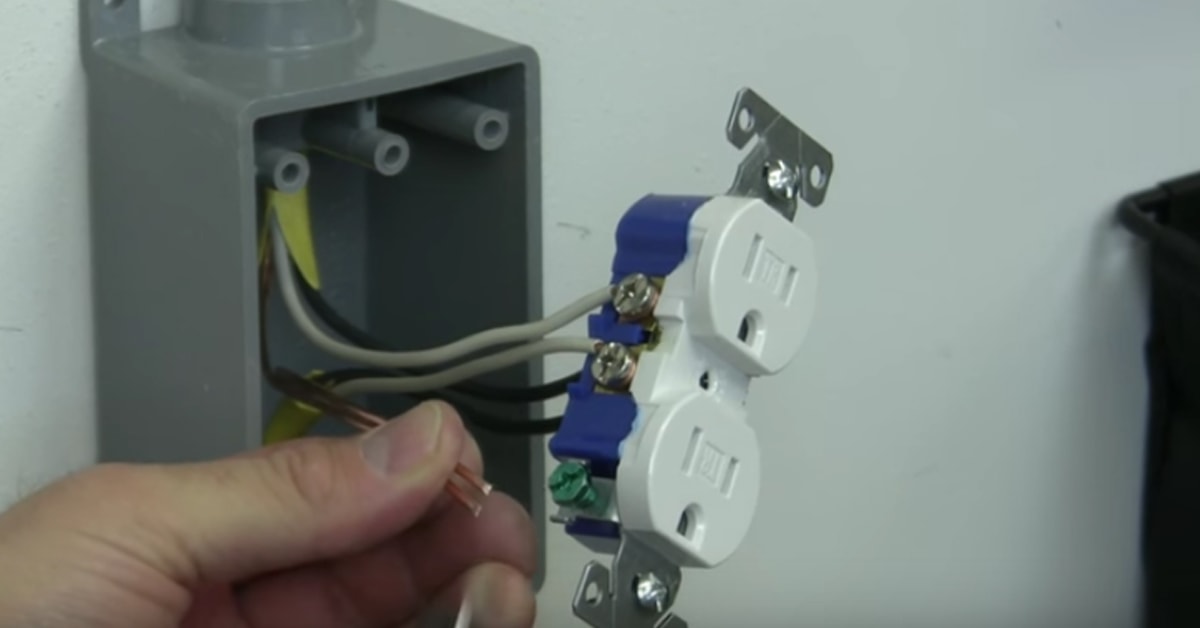

12. Child Proof Your Outlets – Even If You Don’t Have Kids

My first home which was built in 1999 had this next problem. The inside outlets located on the exterior walls were like mini vacuums when it came to transferring air from the inside to the outside.

If you have an older home or a poorly constructed home you’ve probably got the same problem.

Electrical outlet boxes typically don’t have any insulation behind them, creating what is basically a hole in your wall. On a windy day take some incense or a match and put it in front of an outlet (one without a plug in it of course) and see if you can see air movement. In my situation I noticed this during the winter when I felt a cold breeze coming through the outlets.

The simple solution? Install socket sealers to improve energy efficiency. All you have to do is remove your outlet cover with a screwdriver, put on the outlet sealer, and put the cover back on. Easy!

The second step is to put in those plastic child-proof outlet plugs.

13. Insulate Leaky Kitchen and Bathroom Sinks

If you have a sink, toilet, cable or phone line in an external wall, chances are they are uninsulated around behind the wall. Warm and cool air is escaping from these exterior openings.

This one is a bit trickier to determine if you have an air leak. You can use a thermal leak detector to determine if there is a temperature difference by comparing the area near the hole and then the hole itself. If there is a big difference you might want to fix that leak.

Or if you don’t want to spend the money on a thermal imager you can do what I do as soon as I move into a new house. Buy some expanding foam insulation and spray it into every crevice I can find in my exterior walls.